Security & risk

Protect client data, enforce AML checks, and give your firm complete audit visibility with enterprise-grade controls.

Why security is mission-critical for firms

Compliance isn't optional. Without built-in security, firms risk breaches, fines, and lost client trust.

Compliance burden

AML checks done manually, prone to error.

Weak authentication

Passwords alone put data at risk.

No audit trail

Hard to prove compliance without system logs.

Data exposure

Sensitive financial data vulnerable in legacy systems.

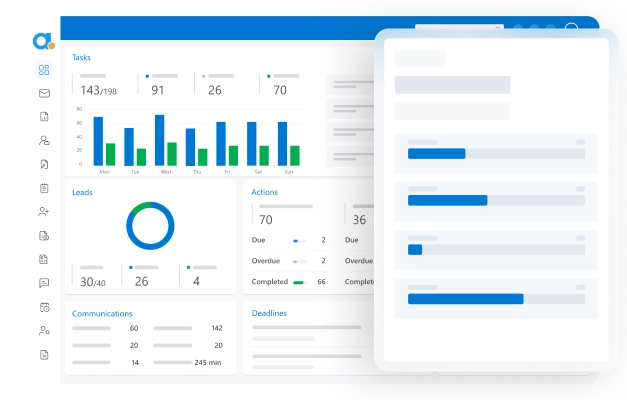

Everything you need to stay secure and compliant

Acting Office bakes security and risk management into the core platform - no bolt-ons required.

Biometric-based AML checks

Automate AML compliance checks.

2-Factor authenticator

Secure, centralised authentication codes.

System logs

Track every user action with full audit trail.

Data security

Protect sensitive client data with encryption and role-based permissions.

Outcomes you can prove to clients and regulators

Security & risk helps firms pass audits, meet obligations, and reassure clients that their data is safe.

Automate AML

No more manual bank imports.

Harden authentication

Real-time data ensures clean ledgers.

Full audit trail

Cloud integrations with no installs.

Protect data

Enterprise-grade API connections.

Built into your firm's workflow

Security & risk integrates with every module - from AML in onboarding to audit logs on every tax filing and payroll approval.

AML

Review

Approval

Submissions

Works seamlessly with other modules

Juggling multiple systems means constant re-keying, duplicate data, and gaps in reporting. Integrations close those gaps.

Core accounts & tax

Enforce secure filings.

Workflow & efficiency

Add approvals with audit trails.

Client experience

Protect e-signatures and communications.

Proof from UK firms

— Compliance Officer, 200-person UK firm.

reduction in regulatory risk exposure.