Core accounts & Tax

One platform to produce accounts, and file tax returns with speed, accuracy, and full compliance.

Why firms struggle with accounts & tax today

Duplicate effort

Accounts and tax returns are prepared in separate systems.

Missed deadlines

VAT, CT600, and SA100 filings too often fall through the cracks.

Disconnected workflows

Payroll, bookkeeping, and accounts don't talk to each other.

Everything you need in one platform

Accounts production

UK GAAP ready with custom validations.

Bookkeeping

Clean, real-time ledgers linked to bank feeds.

Payroll

Accurate runs and HMRC submissions (FPS/EPS).

CT600 filing

Corporation Tax, controlled and compliant.

SA100 filing

Self Assessment, simplified.

VAT (MTD)

PaDirect HMRC connectivity for seamless submissions.yroll

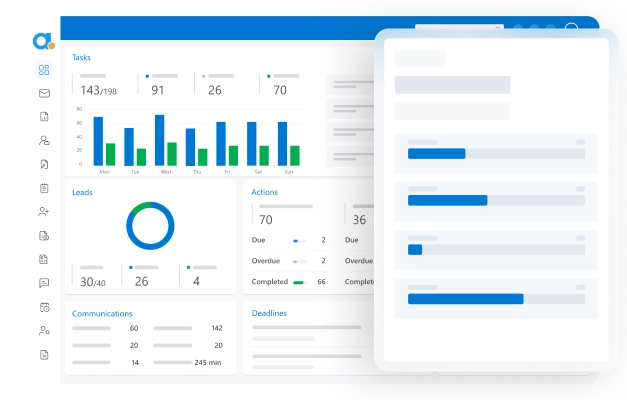

Outcomes you can measure

Firms running Core Accounts & Tax report faster cycles, fewer errors, and more predictable compliance.

Cut prep time

One single unified system.

Stay compliant

Same fields across CRM, Bookkeeping, Tax.

Boost efficiency

Update once, flow everywhere.

Audit trail

A full change history and audit trail across all work.

Built into your firm's workflow

Core Accounts & Tax isn't standalone. It slots directly into your client flow and connects with every other module.

Lead

Onboarding

Bookkeeping

Accounts

CT600/SA100

Works seamlessly with other modules

Connects effortlessly across modules for streamlined workflows and real-time insights.

Workflow & efficiency

Automate deadlines and approvals.

Security & risk

AML checks and audit logs.

Client experience

Engagement letters and e-signatures.

Proof from UK firms

- Managing Partner, UK firm

Faster job tracking across operations.